AI in Insurance Market Size, Share & Growth Report [2032]

AI in Insurance Market Overview:

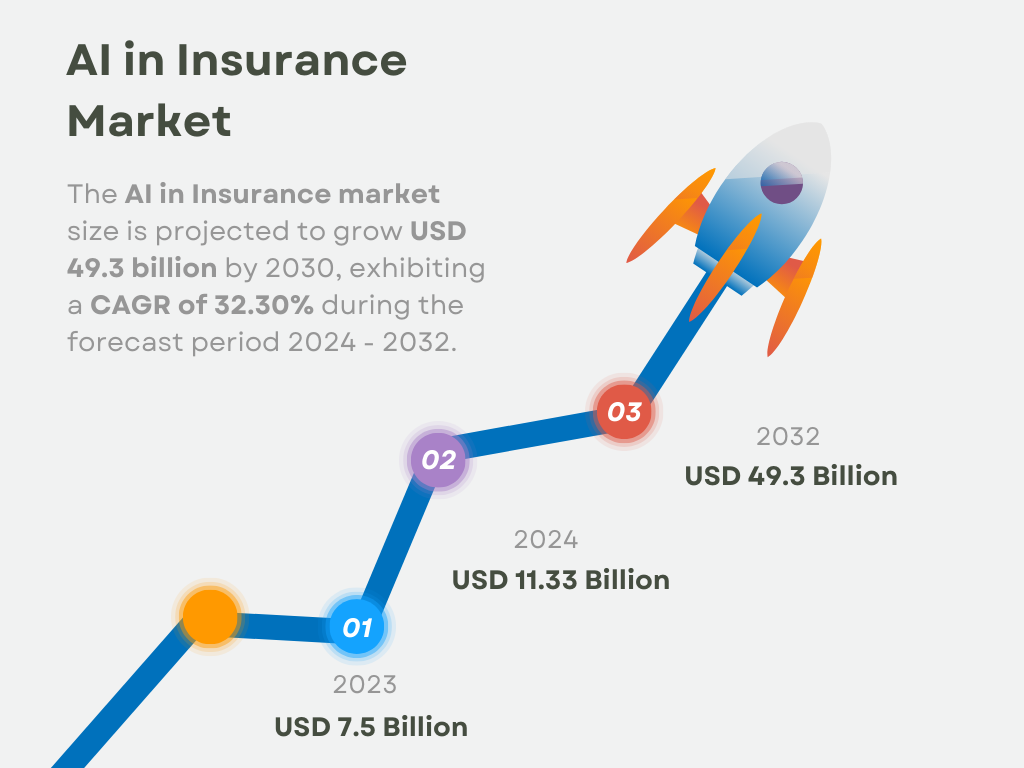

The integration of artificial intelligence (AI) in the insurance industry is rapidly transforming the landscape, offering innovative solutions that streamline operations, enhance customer experiences, and improve risk management. The AI in insurance market has seen significant growth in recent years, driven by the need for efficiency, accuracy, and personalized services. Insurers are increasingly leveraging AI technologies such as machine learning, natural language processing, and predictive analytics to automate processes, detect fraud, assess risks, and provide tailored products to customers. As the industry continues to evolve, AI is expected to play an even more pivotal role, leading to the development of smarter, more agile insurance offerings. The AI in Insurance Market size is projected to grow from USD 11.33 billion in 2024 to USD 49.3 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 32.30% during the forecast period (2024 - 2032).

Get a sample PDF of the report at –

https://www.marketresearchfuture.com/sample_request/8465

Competitive Analysis:

The AI in insurance market is characterized by intense competition, with a mix of established insurers and tech-savvy startups vying for market share. Traditional insurance companies are increasingly collaborating with AI startups to integrate cutting-edge technologies into their existing systems. Key players in the market include,

- IBM

- Microsoft

- Amazon Web Services

which offer AI-driven solutions that enable insurers to harness vast amounts of data for decision-making and customer engagement. Additionally, InsurTech companies like Lemonade and Root are disrupting the market with AI-powered platforms that offer simplified, customer-centric insurance products. The competitive landscape is further intensified by the entry of tech giants and the continuous innovation by startups, making it crucial for players to stay ahead by adopting the latest AI advancements.

Market Drivers:

Several factors are driving the growth of AI in the insurance market. One of the primary drivers is the increasing demand for personalized insurance products. Consumers today expect tailored offerings that meet their specific needs, and AI enables insurers to analyze vast amounts of data to create customized policies. Additionally, the need for operational efficiency is pushing insurers to adopt AI-driven automation. AI technologies can automate repetitive tasks, reduce human error, and streamline processes, leading to significant cost savings. The rise of digital channels and the proliferation of data from various sources, such as IoT devices and social media, are also contributing to the adoption of AI, as insurers seek to leverage this data for more accurate risk assessment and pricing.

Market Restraints:

Despite the numerous advantages, the AI in insurance market faces certain challenges. One of the major restraints is the high implementation cost associated with AI technologies. Developing and integrating AI solutions require significant investment in infrastructure, talent, and training, which can be a barrier for smaller insurers. Additionally, there are concerns about data privacy and security, as the use of AI involves the collection and processing of large volumes of sensitive customer information. Regulatory and compliance issues also pose challenges, as insurers must navigate complex legal frameworks to ensure that their AI-driven operations are compliant with industry standards. Lastly, the lack of transparency in AI algorithms can lead to trust issues among customers, who may be wary of relying on automated decisions without understanding the underlying logic.

Segment Analysis:

The AI in insurance market can be segmented based on component, technology, application, and region. By component, the market is divided into software, hardware, and services. The software segment, which includes AI platforms and solutions, is expected to dominate the market due to the growing demand for AI-powered tools that enhance underwriting, claims processing, and customer service. In terms of technology, the market is segmented into machine learning, natural language processing (NLP), robotic process automation (RPA), and others. Machine learning is anticipated to hold the largest market share, driven by its ability to analyze and learn from vast datasets, improving decision-making processes. The application segment includes claims management, underwriting, customer service, fraud detection, and risk management, with claims management being one of the most significant areas where AI is making an impact. Regionally, the market is analyzed across North America, Europe, Asia Pacific, and the rest of the world.

Browse a Full Report –

https://www.marketresearchfuture.com/reports/ai-in-insurance-market-8465

Regional Analysis:

North America is currently the largest market for AI in insurance, driven by the early adoption of advanced technologies and the presence of major AI vendors in the region. The United States, in particular, is at the forefront, with many insurance companies integrating AI into their operations to stay competitive. Europe follows closely, with countries like the UK, Germany, and France leading the way in AI adoption within the insurance sector. The Asia Pacific region is expected to witness the fastest growth during the forecast period, fueled by the increasing digitalization in countries like China, Japan, and India. The region's expanding middle class and rising awareness of insurance products are also contributing to the growth of AI in insurance. Additionally, the rest of the world, including Latin America, the Middle East, and Africa, is gradually catching up as insurers in these regions begin to explore the potential of AI to enhance their offerings and operations.

The AI in insurance market is poised for significant growth as the industry continues to embrace digital transformation. While there are challenges to overcome, the benefits of AI in terms of efficiency, personalization, and risk management make it a critical tool for the future of insurance. As technology advances and more insurers adopt AI, the market will likely see even greater innovation and competition, leading to more sophisticated and customer-centric insurance solutions.

Top Trending Reports:

Smart Contracts in Healthcare Market

High Altitude Long Endurance Market

Contact

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com

Website: https://www.marketresearchfuture.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness