Payment Gateway Market Emerging Trends, Demand, Revenue and Forecasts Research 2032

Unlocking Seamless Transactions: A Comprehensive Overview of the Payment Gateway Market

The payment gateway market is a crucial component of the digital economy, enabling secure and efficient processing of online transactions. As e-commerce continues to thrive and digital payments gain prominence, the demand for robust payment gateways is rising. This article provides an in-depth analysis of the payment gateway market, covering market overview, key segments, latest industry news, leading companies, market drivers, and regional insights. The payment Gateway market industry is projected to grow from USD 27.3 Billion in 2023 to USD 138.5 Billion by 2032.

Market Overview

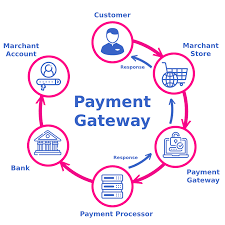

A payment gateway acts as an intermediary between merchants and financial institutions, facilitating the authorization and processing of online payments. It ensures that sensitive information, such as credit card details, is encrypted and securely transmitted. The market for payment gateways has expanded significantly due to the proliferation of online shopping, mobile payments, and the increasing need for secure transaction methods.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/18853

Key Market Segments

The payment gateway market can be segmented based on various factors:

- Type of Payment Gateway:

- Hosted Payment Gateways: These gateways redirect customers to the payment service provider’s (PSP) page to complete transactions. Examples include PayPal and Stripe.

- Self-Hosted Payment Gateways: Merchants collect payment details on their website and then send the information to the gateway. Examples include Authorize.Net and Adyen.

- API/Non-Hosted Payment Gateways: These gateways allow merchants to handle transactions directly on their websites via an API. Examples include Square and Braintree.

- End Users:

- Retail and E-commerce: Payment gateways are essential for processing transactions in online stores.

- Travel and Hospitality: Online bookings for flights, hotels, and travel packages require reliable payment solutions.

- Healthcare: Hospitals and clinics use payment gateways for billing and online payments.

- Education: Educational institutions utilize payment gateways for tuition fee payments and other charges.

- Enterprise Size:

- Small and Medium Enterprises (SMEs): SMEs benefit from affordable and easy-to-integrate payment solutions.

- Large Enterprises: Large corporations require scalable and customizable payment gateway solutions to handle high transaction volumes.

Industry Latest News

The payment gateway industry is dynamic, with continuous advancements and innovations. Here are some of the latest trends and news:

- Integration of Cryptocurrencies: Payment gateways are increasingly supporting cryptocurrencies, providing consumers with more payment options. Companies like BitPay and Coinbase are at the forefront of this trend.

- Enhanced Security Measures: The industry is investing in advanced security technologies like tokenization, 3D Secure, and biometric authentication to combat fraud and enhance transaction security.

- Expansion into Emerging Markets: Payment gateway providers are expanding their reach into emerging markets in Asia, Africa, and Latin America to tap into the growing e-commerce and digital payment ecosystems.

- AI and Machine Learning: These technologies are being leveraged to improve fraud detection, personalize payment experiences, and optimize transaction processes.

Payment Gateway Companies

Several companies are leading the way in the payment gateway market, offering innovative solutions and services:

- PayPal Holdings Inc.: A global leader in digital payments, PayPal offers a comprehensive payment gateway solution for businesses of all sizes.

- Stripe Inc.: Known for its developer-friendly APIs, Stripe provides powerful and flexible payment solutions for online businesses.

- Square Inc.: Offers a range of payment solutions, including a payment gateway, point-of-sale systems, and mobile payment options.

- Adyen N.V.: A Dutch company providing a unified payment platform for global businesses, supporting various payment methods and currencies.

- Authorize.Net (a subsidiary of Visa Inc.): One of the oldest and most trusted payment gateway providers, serving a wide range of businesses.

- Worldpay (a subsidiary of FIS): Offers comprehensive payment solutions, including a robust payment gateway for online transactions.

Market Drivers

Several factors are driving the growth of the payment gateway market:

- E-commerce Boom: The rapid growth of online shopping is a significant driver, as payment gateways are essential for processing e-commerce transactions.

- Mobile Payment Adoption: Increasing use of smartphones for payments is boosting demand for mobile-friendly payment gateway solutions.

- Security Concerns: The need for secure payment processing is driving businesses to adopt reliable payment gateways with advanced security features.

- Globalization of Businesses: As businesses expand globally, they require payment gateways that support multiple currencies and payment methods.

- Technological Advancements: Innovations in fintech, including blockchain and artificial intelligence, are enhancing the capabilities of payment gateways.

Regional Insights

The payment gateway market varies across regions based on factors like technological infrastructure, regulatory environment, and consumer behavior. Here are some regional insights:

-

North America: The region is a leader in the payment gateway market, driven by high e-commerce adoption, advanced technology infrastructure, and strong presence of key players like PayPal and Stripe. The United States is the largest market, with Canada also contributing significantly.

-

Europe: Europe has a mature payment gateway market, with widespread adoption of digital payments. The European Union's regulations, such as PSD2, promote innovation and competition in the market. Key markets include the UK, Germany, and France, with companies like Adyen and Worldpay playing major roles.

-

Asia-Pacific: The region is experiencing rapid growth in the payment gateway market, fueled by the rise of e-commerce and mobile payments. China is a dominant player, with Alipay and WeChat Pay leading the market. India, Japan, and Southeast Asian countries are also witnessing significant growth, driven by government initiatives and increasing internet penetration.

-

Latin America: The digital payment landscape in Latin America is evolving, with Brazil and Mexico being key markets. The region is characterized by increasing adoption of online payments and the presence of local payment gateway providers like MercadoPago and PagSeguro.

-

Middle East and Africa: The payment gateway market in the Middle East and Africa is gradually expanding, with a focus on financial inclusion and mobile money services. Countries like the UAE, South Africa, and Nigeria are leading the market, leveraging mobile technology to provide financial services to underserved populations.

Ask for Customization - https://www.marketresearchfuture.com/ask_for_customize/18853

Future Prospects

The future of the payment gateway market looks promising, with continuous technological advancements and increasing consumer adoption. Key trends to watch include:

- Integration of Advanced Technologies: Artificial intelligence, machine learning, and blockchain will continue to enhance payment gateway capabilities, improving security, efficiency, and personalization.

- Increased Focus on User Experience: Payment gateway providers will prioritize seamless and user-friendly experiences, integrating various payment methods and optimizing transaction processes.

- Expansion into New Markets: Providers will explore new markets and regions, targeting emerging economies with growing e-commerce and digital payment ecosystems.

- Collaborations and Partnerships: Strategic collaborations between payment gateway providers, fintech companies, and financial institutions will drive innovation and expand service offerings.

- Regulatory Developments: Evolving regulations will shape the market landscape, with a focus on security, privacy, and consumer protection.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness