Aircraft Insurance Market Dynamics: Growth Insights and Future Forecast (2024-2033)

Aircraft Insurance Market Insights

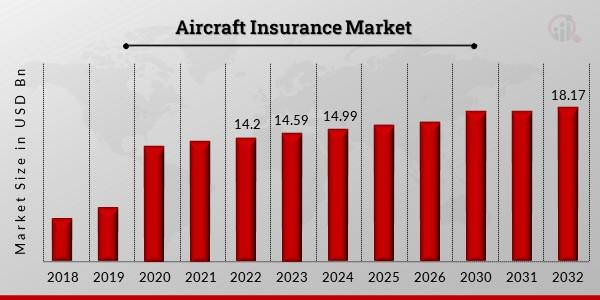

In an increasingly interconnected world, air travel has become essential for both personal and commercial purposes. With the rise of commercial aviation, the need for aircraft insurance has grown substantially. A recent study by Market Research Future reveals that the global aircraft insurance market was valued at USD 14.59 billion in 2023 and is projected to grow from USD 14.995 billion in 2024 to USD 18.17 billion by 2032. This growth corresponds to a compound annual growth rate (CAGR) of 2.42% during the forecast period from 2024 to 2032. This blog explores the key drivers fueling the growth of the aircraft insurance market, examines the competitive landscape, and provides insights into market segmentation and future prospects.

Understanding the Aircraft Insurance Market

Aircraft insurance is a specialized form of insurance designed to cover various risks associated with operating aircraft, including physical damage, liability, and loss of income due to grounded aircraft. It serves as a safety net for airlines, cargo operators, and private aircraft owners, mitigating financial risks and ensuring compliance with regulatory requirements.

Key Drivers of Market Growth

-

Increasing Use of Drones

The rise in drone usage for various applications, including aerial photography, surveying, agriculture, and delivery services, has created a new segment within the aircraft insurance market. As drones become more prevalent, insurance providers are expanding their offerings to include coverage tailored specifically for unmanned aerial vehicles (UAVs). This trend is expected to drive growth, as operators seek insurance to mitigate liability risks and comply with regulations. -

Strict Government Regulations

Government regulations play a significant role in shaping the aircraft insurance market. Aviation authorities worldwide have implemented stringent regulations to ensure passenger safety and operational standards. These regulations often require aircraft operators to maintain specific levels of insurance coverage, further driving demand for insurance products. Regulatory bodies, such as the Federal Aviation Administration (FAA) in the United States and the European Union Aviation Safety Agency (EASA), impose requirements that compel operators to secure adequate insurance, thus bolstering the market. -

Increased Government Investments in Airport Infrastructure

Many governments are investing heavily in the development of new airports and the renovation of existing ones to accommodate the growing demand for air travel. These investments not only enhance the overall safety and efficiency of the aviation sector but also create opportunities for insurance providers. As new airports are built and existing facilities are upgraded, the need for comprehensive insurance coverage for various stakeholders, including airlines and airport operators, will continue to rise. -

Growth of the Global Aviation Sector

The global aviation sector is experiencing robust growth, driven by rising disposable incomes, increasing tourism, and the expansion of e-commerce. As more people take to the skies and businesses rely on air transport for logistics, the demand for aircraft insurance is expected to rise correspondingly. With a growing number of aircraft in operation, insurance providers will see increased opportunities to offer tailored coverage solutions to meet the unique needs of different operators. -

Emergence of Advanced Technologies

The incorporation of advanced technologies, such as artificial intelligence (AI), machine learning, and data analytics, is transforming the aircraft insurance market. These technologies allow insurers to assess risks more accurately, streamline underwriting processes, and enhance customer experience. Insurers leveraging technology can provide personalized policies and pricing, ultimately leading to increased market penetration and customer satisfaction.

Competitive Landscape

The aircraft insurance market is characterized by the presence of several key players, each competing to capture market share and meet the evolving needs of clients. Some of the prominent players in the industry include:

-

AIG (American International Group)

AIG is a leading global insurer providing comprehensive aviation insurance solutions, including hull and liability coverage for various types of aircraft. -

Berkshire Hathaway

Berkshire Hathaway offers specialized aviation insurance products through its subsidiary, Berkshire Hathaway Specialty Insurance, catering to both commercial and general aviation sectors. -

Allianz Global Corporate & Specialty (AGCS)

AGCS provides a range of aviation insurance products, including coverage for commercial airlines, cargo operators, and private aircraft owners, supported by a strong global presence. -

Lloyd's of London

Known for its unique insurance marketplace, Lloyd's is home to several syndicates offering specialized aircraft insurance solutions tailored to the needs of aviation clients. -

Chubb Limited

Chubb offers a variety of aviation insurance products, including coverage for commercial aviation, general aviation, and unmanned aerial vehicles (UAVs), backed by a strong financial foundation.

These companies are focusing on product innovation, strategic partnerships, and enhanced customer service to differentiate themselves in a competitive landscape.

Segmentation of the Aircraft Insurance Market

The aircraft insurance market can be segmented based on several factors, including:

-

By Insurance Type

- Hull Insurance: Covers physical damage to the aircraft.

- Liability Insurance: Provides coverage for third-party claims arising from aircraft operations.

- Passenger Insurance: Offers coverage for passenger injuries or fatalities.

-

By Application

- Commercial Aviation: Insurance for airlines and charter services.

- General Aviation: Coverage for private aircraft owners and small operators.

- Cargo Aviation: Insurance for cargo airlines and freight operations.

-

By Region

- North America: Dominated by established aviation markets and stringent regulations.

- Europe: Significant growth driven by increasing air travel and government initiatives.

- Asia-Pacific: Rapidly expanding aviation sector, particularly in countries like China and India.

- Latin America: Emerging market opportunities fueled by tourism and economic growth.

- Middle East & Africa: Increasing investments in aviation infrastructure and air travel.

Future Outlook

The aircraft insurance market is poised for steady growth over the next several years. With an anticipated increase in air travel, advancements in aviation technology, and the rise of new operational segments like drones, the demand for aircraft insurance is expected to remain strong.

The projected growth from USD 14.995 billion in 2024 to USD 18.17 billion by 2032 reflects the increasing importance of risk management in the aviation sector. Insurers will need to adapt to changing market dynamics and leverage technology to enhance underwriting processes and improve customer service.

Moreover, as the aviation industry continues to evolve, stakeholders must stay abreast of regulatory changes and emerging trends to effectively navigate the complexities of the aircraft insurance landscape. Collaborations between insurers, aviation operators, and technology providers will be essential for developing innovative insurance solutions that meet the needs of a rapidly changing market.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : @ https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=9535

Conclusion

The aircraft insurance market is undergoing a transformation driven by increasing air travel, technological advancements, and regulatory requirements. With a valuation of USD 14.59 billion in 2023 and a projected growth trajectory, the market presents significant opportunities for insurers and aviation stakeholders alike.

As the industry evolves, embracing new technologies and addressing emerging risks will be critical for ensuring safety and sustainability in air travel. By adapting to changing dynamics and fostering collaboration, the aircraft insurance market can continue to thrive and support the growth of the global aviation sector.

For more in-depth insights and data on the aircraft insurance market, visit Market Research Future.

About US

Market Research Future (MRFR) is a global market research company that takes pride in its services, offering a complete and accurate analysis with regard to diverse markets and consumers worldwide. Market Research Future has the distinguished objective of providing the optimal quality research and granular research to clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help answer your most important questions.

Contact US

Market Research Future (part of Wantstats Research and Media Private Limited),

99 Hudson Street,5Th Floor New York 10013, United States of America

Sales: +1 628 258 0071 (US) +44 2035 002 764 (UK)

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness