Cyber Insurance Industry 2024-2033: A Comprehensive Overview of Market Trends and Growth Potential

Cyber Insurance Market Overview Introduction

The digital age has brought about tremendous benefits for businesses, governments, and individuals. However, it has also ushered in a new era of vulnerabilities—cyberattacks, data breaches, ransomware, and other cyber threats are becoming more sophisticated and frequent. In response to this growing threat landscape, the cyber insurance market has gained significant momentum over the last decade. Businesses of all sizes are turning to cyber insurance as a necessary safeguard against the financial and reputational risks posed by these attacks.

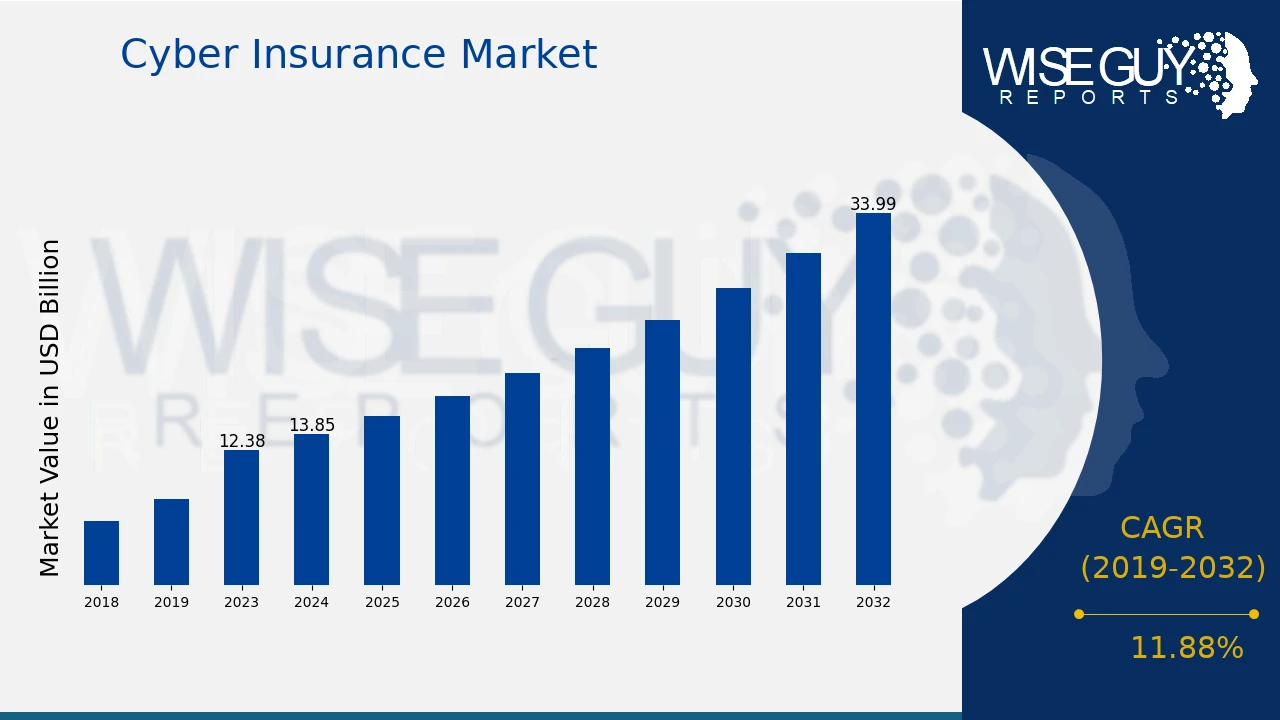

In 2023, the cyber insurance market was estimated at $12.38 billion, and it is projected to reach $34 billion by 2032, growing at a compound annual growth rate (CAGR) of 11.88% during the forecast period (2024-2032). This rapid expansion is driven by a combination of factors, including the increasing frequency of cyberattacks, evolving regulatory frameworks, and the growing awareness among organizations about the importance of risk mitigation in a connected world.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰 @: https://www.wiseguyreports.com/reports/cyber-insurance-market

Overview of the Cyber Insurance Market

Cyber insurance provides financial protection to businesses in the event of cyberattacks or data breaches. Policies typically cover the costs associated with incident response, data recovery, legal liabilities, public relations, and potential regulatory fines. The demand for cyber insurance has grown as companies across industries recognize the potentially devastating impact of cyber incidents on their operations.

The cyber insurance market is not just expanding but evolving. Insurers are constantly adapting to new forms of cyber threats, offering policies that provide greater flexibility and coverage. As the digital ecosystem becomes more complex with the proliferation of technologies like artificial intelligence, the Internet of Things (IoT), and cloud computing, the need for comprehensive cyber insurance solutions will become even more critical.

Market Size and Growth Projections

As mentioned, the global cyber insurance market was valued at $12.38 billion in 2023 and is expected to grow to $13.85 billion by 2024, with a projected increase to $34 billion by 2032. The growth of this market is primarily fueled by several key factors that are reshaping how organizations perceive and respond to cyber risks.

The increasing dependence on digital systems, data, and networks means that businesses across various sectors are exposed to cyber risks. Furthermore, the surge in remote work due to the COVID-19 pandemic has introduced new security challenges, making cyber insurance an essential tool for mitigating these emerging risks. As businesses continue to digitize their operations and cyber threats become more sophisticated, the demand for cyber insurance is expected to rise exponentially, contributing to the market’s robust growth.

Key Drivers of Market Growth

Several factors are driving the expansion of the cyber insurance market. These include:

- Rising Frequency and Sophistication of Cyberattacks: Cyberattacks are growing not only in frequency but also in complexity. High-profile ransomware attacks, data breaches, and phishing scams have made headlines in recent years, underscoring the need for comprehensive cybersecurity strategies, including cyber insurance.

Attacks such as the Colonial Pipeline ransomware incident and the SolarWinds hack have highlighted the vulnerability of critical infrastructure and large corporations, pushing businesses to consider insurance as part of their cybersecurity risk management strategy. The increasing use of technology, from cloud services to IoT devices, means that attack surfaces are expanding, making it easier for cybercriminals to exploit vulnerabilities.

- Stringent Regulatory Environment: Governments and regulatory bodies are implementing stricter regulations related to data protection and privacy. Laws like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) impose heavy fines on companies that fail to protect customer data. As regulatory scrutiny intensifies, companies are seeking cyber insurance to shield themselves from the financial and reputational damage of non-compliance.

In addition, cybersecurity frameworks and standards such as the NIST Cybersecurity Framework are becoming more commonly adopted, further reinforcing the need for businesses to have a robust risk mitigation plan in place, including insurance.

- Increased Adoption of Digital Technologies: The rapid adoption of emerging technologies like AI, IoT, and cloud computing introduces new vulnerabilities that cybercriminals can exploit. As businesses embrace digital transformation initiatives, the cyber threat landscape broadens, creating more opportunities for malicious actors to target sensitive data and critical infrastructure.

AI and IoT devices, for instance, are often connected to vast networks, and any breach in one part of the system can result in a cascading effect. As companies continue to innovate and integrate these technologies into their operations, cyber insurance will become increasingly important to protect against new and unknown risks.

𝐆𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 @ : https://www.wiseguyreports.com/sample-request?id=571502

- Rising Awareness Among Small and Medium Enterprises (SMEs): While large corporations have traditionally been the primary buyers of cyber insurance, the rise in targeted attacks on small and medium-sized enterprises (SMEs) has made cyber insurance more relevant for this segment. SMEs are often more vulnerable to cyberattacks due to limited resources and weaker cybersecurity defenses, making them prime targets for cybercriminals. Cyber insurance offers them a safety net to recover from financial losses and operational disruptions caused by cyber incidents.

Competitive Landscape

The cyber insurance market is highly competitive, with numerous players ranging from traditional insurance companies to specialist providers. Some of the key players in the market include:

- AIG (American International Group, Inc.): One of the leading players in the cyber insurance market, AIG offers a range of customizable cyber insurance products designed to meet the needs of businesses of all sizes. The company is known for its extensive global network and expertise in managing complex risks.

- Chubb Limited: Chubb is a prominent player in the cyber insurance market, offering tailored solutions that provide protection against a broad spectrum of cyber risks. The company has a strong focus on providing coverage for SMEs and large corporations alike.

- Allianz: As one of the largest insurers in the world, Allianz has a significant presence in the cyber insurance market. The company provides comprehensive cyber insurance policies that include risk assessment, incident response services, and coverage for legal liabilities.

- AXA XL: AXA XL, a subsidiary of AXA Group, is known for its innovative approach to cyber insurance. The company offers customized policies that cater to businesses with complex cyber risk profiles, providing a high level of protection against both known and emerging threats.

- Munich Re: A key player in the reinsurance market, Munich Re also has a strong presence in the cyber insurance space. The company focuses on helping insurers manage their exposure to cyber risks through tailored reinsurance solutions.

Segmentation of the Cyber Insurance Market

The cyber insurance market can be segmented based on several criteria, including coverage type, organization size, and industry vertical.

- By Coverage Type: The market is segmented into first-party coverage and third-party coverage. First-party coverage protects against direct losses suffered by the insured entity, such as data restoration and business interruption. Third-party coverage, on the other hand, addresses claims and lawsuits brought by affected individuals or organizations.

- By Organization Size: The market can be segmented into large enterprises and small and medium-sized enterprises (SMEs). Large enterprises have been the dominant segment due to their more complex cybersecurity needs and greater exposure to cyber threats. However, SMEs are expected to see the fastest growth in adoption due to rising awareness and affordability of cyber insurance policies.

- By Industry Vertical: The demand for cyber insurance varies across industries. The financial services sector has been the largest buyer of cyber insurance, given the sensitive nature of financial data and the highly regulated environment. Other major sectors include healthcare, retail, technology, and manufacturing.

Regional Analysis

The cyber insurance market exhibits regional variations, with North America dominating the global market due to the high prevalence of cyberattacks and the advanced regulatory environment. The United States, in particular, has been a major driver of market growth, with stringent data privacy laws and a high level of cybercrime incidents pushing businesses to invest in insurance.

Europe is the second-largest market, driven by the implementation of GDPR and the growing awareness of cyber risks across industries. The region has seen steady growth in the adoption of cyber insurance, particularly in sectors like finance and healthcare.

Asia-Pacific is expected to witness the fastest growth during the forecast period. The increasing digitization of economies like China, India, and Japan, along with a rising number of cyberattacks, is fueling demand for cyber insurance in the region. Regulatory frameworks are also evolving, encouraging businesses to adopt risk management solutions like insurance.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : @ https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=571502

Conclusion

The cyber insurance market is poised for significant growth in the coming years, driven by the rising frequency of cyberattacks, regulatory pressures, and increased adoption of digital technologies. With a projected market size of $34 billion by 2032, the industry is evolving rapidly to meet the changing needs of businesses in a hyper-connected world.

Organizations, regardless of size or industry, must recognize the importance of comprehensive cyber insurance as part of their broader cybersecurity strategy. As the threat landscape continues to evolve, the role of cyber insurance will only become more critical in helping businesses mitigate financial risks and safeguard their operations.

Browse Related Report:

Virtual Training And Simulation Market Overview : https://www.wiseguyreports.com/reports/virtual-training-and-simulation-market

Simulation Software Market Overview : https://www.wiseguyreports.com/reports/simulation-software-market

Satellite Antenna Market Overview : https://www.wiseguyreports.com/reports/satellite-antenna-market

Atv And Utv Market Overview : https://www.wiseguyreports.com/reports/atv-and-utv-market

Army Primary Combat Systems Growth Opportunities Market Overview : https://www.wiseguyreports.com/reports/army-primary-combat-systems-growth-opportunities-market

Mobile Situational Awareness Solutions Market Overview : https://www.wiseguyreports.com/reports/mobile-situational-awareness-solutions-market

Ai-Enabled Biometric Market Overview : https://www.wiseguyreports.com/reports/ai-enabled-biometric-market

Artificial Intelligence In Military Market Overview : https://www.wiseguyreports.com/reports/artificial-intelligence-in-military-market

Military Displays Market Overview : https://www.wiseguyreports.com/reports/military-displays-market

Limousine Services Market Overview : https://www.wiseguyreports.com/reports/limousine-services-market

Next Generation Biometrics Market Overview : https://www.wiseguyreports.com/reports/next-generation-biometrics-market

Intrusion Detection Prevention Systems Market Overview : https://www.wiseguyreports.com/reports/intrusion-detection-prevention-systems-market

Small Satellites Market Overview : https://www.wiseguyreports.com/reports/small-satellites-market

About Wise Guy Reports

We Are One Of The World's Largest Premium Market Research & Statistical Reports Centre

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

Integrity and ethical conduct are at the core of everything done within Wise Guy Reports. We ensure transparency, fairness, and integrity in all aspects of our business operations, including interactions with clients, partners, and stakeholders, by abiding by the highest ethical standards.

Contact US

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028 Maharashtra, India 411028

Sales +91 20 6912 2998

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness